Students spend their high school years learning topics that help them pass state or nationally mandated exams, but do not provide much benefit after high school. Requiring students to take a financial literacy course would allow students to learn foundational economics, teach students responsibility that may not be taught at home and help them prepare for college and retirement.

On April 26, the Florida Senate approved a bill that made it mandatory for students entering high school in the 2017-18 school year to take a half year financial literacy course. The bill, Dorothy L. Hukill Financial Literacy Education Act, was named after the Port Orange, Fla. senator who diligently pushed for financial literacy in high school education.

The freshman financial literacy class will create a solid foundation for their future senior economics class, which teaches basic economics such as balancing a checkbook, completing a loan application and learning basic money principles, such as interest rates.

This knowledge of economics proves essential for future success. Without this class, students would feel clueless on the important aspects of managing money.

Furthermore, high school students struggle to decipher basic economic concepts. Joseph Calhoun, associate economics professor at Florida State University, stated half of his students struggle with stating the difference between a stock and a bond. Students also do not understand other financial functions, such as how credit cards work and debt accumulation. Credit cards allow one to make convenient purchases and pay back such purchases at a later date. Debt accumulation can impact one’s credit scores, lead to stress and create higher interest rates. Expanding on these topics proves essential for students to learn ways to substantially improve their financial status.

Additionally, a required financial literacy course would help teach students responsibility. Since financial literacy may not get enough emphasis at home, students feel unaware about money management. This often causes them to not possess money saving skills, which results in over spending and accumulating bad credit.

According to Fox Business, 83 percent of teens do not know proper money management skills, such as handling personal financial endeavors, saving and credit accumulation. Nine out of 10 teens believe their parents provide solid examples of proper money management, while one in five parents say they are not strong examples. Parents do not feel confident in their abilities to teach their children about personal finances, with 40 percent of parents admitting the stagnant economy caused them to sacrifice funds to their children’s savings accounts. Requiring a financial literacy course can help parents teach their kids proper financial skills. When schools assist in teaching students about financial literacy, students become more independent and find themselves less anxious about learning from their parents.

Moreover, financial literacy as a high school course allows students to benefit in future endeavors, such as college and retirement. Key principles taught in this class translate into realistic aspects of life. According to Concordia University, one should have, at minimum, a six month “rainy day” savings for rent and living expenses in case of emergency or job loss. However, with an estimated 50 to 75 percent of Americans living pay check to pay check, keeping a savings account seems daunting. The concept of “paying yourself first,” which involves taking a standard percentage from each paycheck earned, placing it in a separate account and pretending it doesn’t exist is a simple concept and essential for students to learn to save money. This idea benefits future savings, especially for retirement planning.

For example, the average American obtains a stable job at the age of 22. If one were to put $20 into an untouchable savings account every week for 45 years, he would retire with $331,553, not including an average interest rate of 0.06 percent. A financial literacy course can help students learn to live with their financial means. According to Employee Benefit Research Institute, only 22 percent of Americans feel comfortable with their finances to retire comfortably. Teaching students about placing money in a savings account and compound interest would allow them to reap the benefits of future savings.

According to the Financial Educators Council, college students increasingly feel the effects of the price of college, causing drop out rates to soar because of these financial pressures. A 2014 USA Today study on 65,000 college students found first-year college students who took a financial literacy course in high school drastically handled credit and student loans better than their peers that did not.

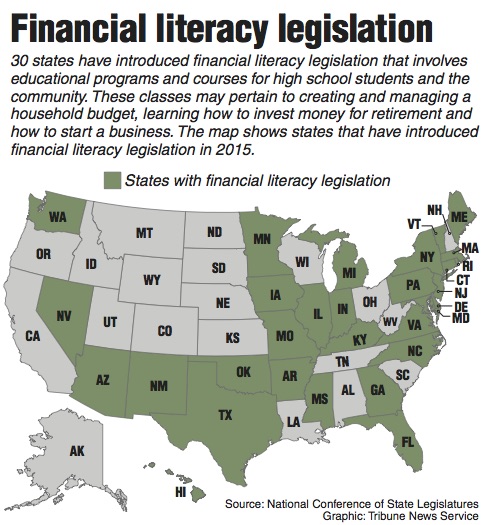

While this bill benefits students’ lives in the future, it could lead to unfortunate compromises. Making financial literacy a graduation requirement causes students to lose other important electives like arts and physical education. However, states should see the lasting effects of financial literacy and join the bandwagon. As of 2015, 30 states require a high school financial literacy credit.

Knowledge of financial literacy helps create a fiscally responsible society who are ready for the future. This course will influence the students of today to become the leaders of tomorrow. Financial literacy is an essential course because it teaches basic economics, provides students an opportunity to learn economics outside of home and allows students to prepare for the future.